Overtime Lawyer in Daytona Beach, FL

Board-Certified

Expertise in Florida

Employment Law

- Kelly Chanfrau is a board-certified labor law attorney

- Representing both employees and employers in wage and hour disputes

- Skilled in federal and state overtime, classification, and compliance law

- Trusted by Florida workers and businesses for honest case evaluation

Meet Kelly Chanfrau, JD

Board-Certified Expert in Florida Labor & Employment Law

Kelly Chanfrau has a deep understanding of wage and hour disputes, backed by board certification in labor and employment law. She’s been nationally recognized for her work representing employees in cases involving unpaid wages, discrimination, retaliation, and more.

Why Clients Trust Kelly With Employment Law Cases

- Board certified in Labor & Employment Law by the Florida Bar

- Named one of the Top 500 Employment Lawyers in the U.S.

- Extensive experience with Department of Labor audits and investigations

- Represents clients in cases involving unpaid overtime, retaliation, and misclassification

- Known for her honest case evaluations and outcome-driven approach

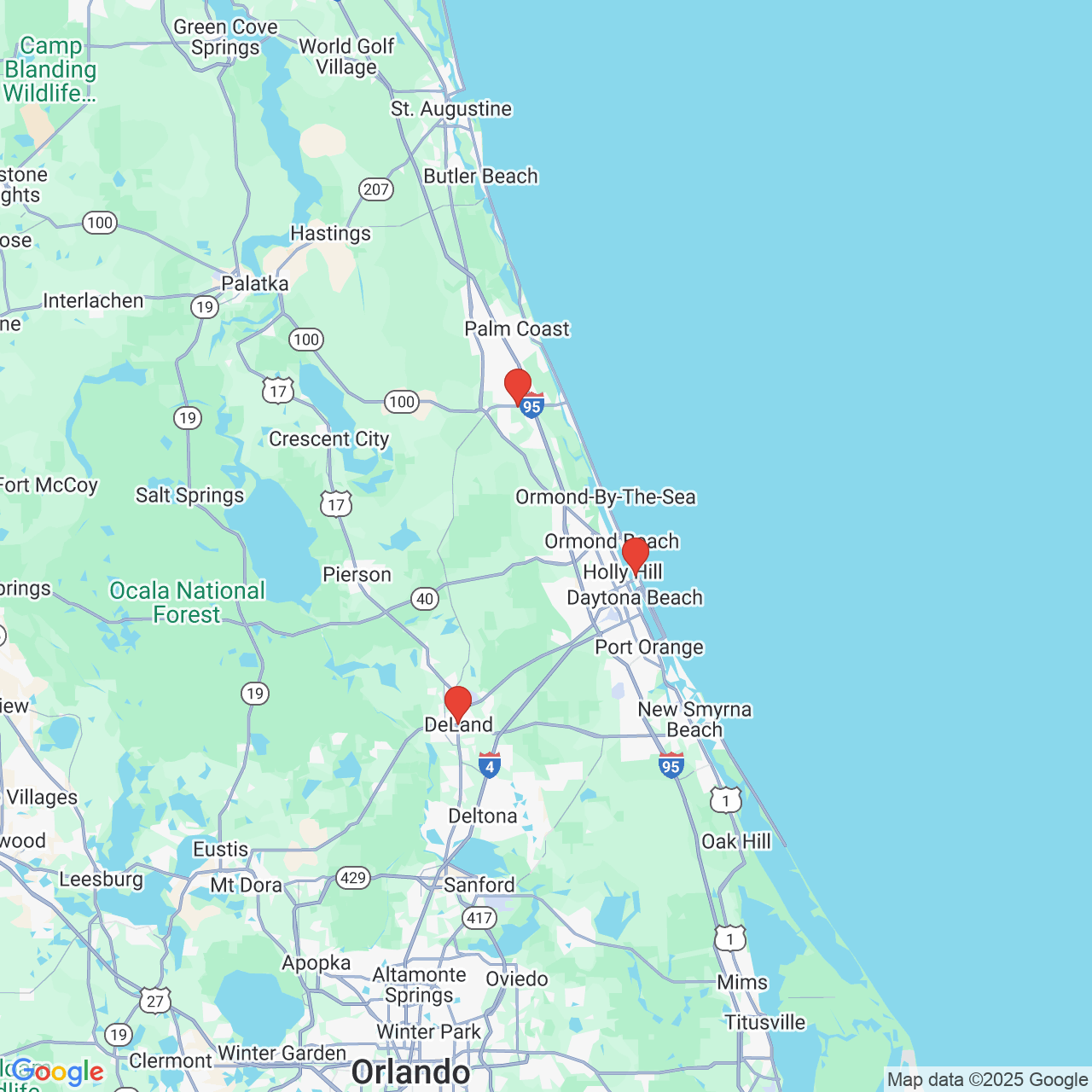

Whether you’re facing an overtime dispute or navigating a Department of Labor investigation, you can meet with us at our offices in Daytona Beach, Palm Coast, or DeLand. Consultations are always free.

Honest Advocacy

in Florida Employment Law

Kelly shares what drives her work in employment law and why honest case evaluation is so important. Learn what sets Chanfrau & Chanfrau apart when it comes to fighting for Florida workers and protecting their rights under the law.

“If you are looking for a POWERFUL lawyer who will listen to you, take complete charge of your situation and make things happen, Kelly Chanfrau is your person! Kelly was nothing but incredibly professional, extremely knowledgeable on the subject matter at hand, and genuinely cared about me and my case. If you are looking for a lawyer who is competent and caring, Kelly Chanfrau is your answer."

— SBR, 5-Star Review

Misclassification Is Common — and Costly for Both Sides

One of the most frequent issues in wage and hour law is misclassification. Sometimes, employees are incorrectly labeled as independent contractors or “exempt” from overtime. Other times, employers misclassify roles unintentionally, creating risk for Department of Labor audits, back pay liability, and penalties.

Our team serving Daytona Beach, Palm Coast, and other Florida communities has helped both employees and employers navigate misclassification issues, such as:

- Employees unsure if they’re owed unpaid overtime or an hourly amount that totals minimum wage

- Independent contractors who believe they function as employees

- Salaried workers not receiving overtime, despite being nonexempt

- Employers seeking to correct classification errors before facing legal action

- Businesses responding to Department of Labor complaints or audits

We analyze hours worked, duties performed, and applicable state and federal wage laws to determine the correct classification and resolve issues. Whether you’re asserting your rights or protecting your organization, we’ll guide you through the legal process.

Related Employment Law Services

Our overtime lawyer serving Daytona Beach, Palm Coast, and beyond also handles a range of employment issues beyond unpaid wages and overtime disputes:

If your wage claim is part of a broader legal issue, we’re ready to help.

Frequently Asked Questions

for Our Overtime Lawyer

in Daytona Beach, FL

Is Florida’s minimum wage different from the federal rate?

Yes. Florida has its own minimum wage laws, which often exceed the federal rate and adjust annually for the cost of living.

Does Chanfrau & Chanfrau take employer defense cases?

Yes. We represent both employees and employers in wage and hour disputes, offering strategic counsel on either side of the issue.

How do I know if I qualify for overtime pay?

We’ll evaluate your job duties, classification, and pay records under both Florida and federal law to determine if you’re legally owed overtime.

“Kelly is amazing.”

“Kelly is amazing and she really cares about you as a person. If ever I need a lawyer again, they will be my first call! Thank you all so much for your hard work and dedication!!!!” — Cupcake Lady, 5-Star Review